The gross domestic product (GDP) rate of 6.4% will be the lowest since the year of Covid (2020-21). File

| Photo Credit: PTI

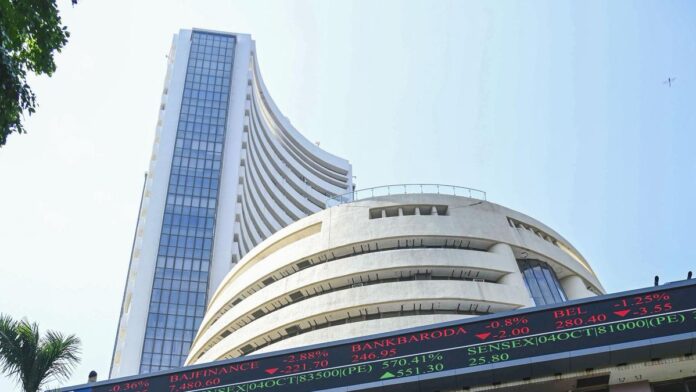

Equity benchmark indices Sensex and Nifty ended marginally lower in a volatile session on Wednesday (January 8, 2025), as investors stayed on the sidelines ahead of the earnings season amid lower economic growth projections.

Unabated foreign fund outflows and mixed global market cues also dented sentiments.

However, buying in bellwether stocks TCS and Reliance Industries managed to restrict a steep decline in markets, traders said.

The 30-share BSE benchmark Sensex fell 50.62 points or 0.06% to settle at 78,148.49. During the day, it dropped 712.32 points or 0.91% to 77,486.79.

The NSE Nifty skidded 18.95 points or 0.08% to 23,688.95.

“Slowing economic growth projections and caution ahead of Q3 numbers added volatility in the market. However, the market witnessed a recovery from the day’s low owing to the accumulation of beaten-down blue-chip stocks and in expectation of government reforms in the upcoming budget to lift the tepid economy. The near-term sentiment is likely to be subdued due to the rise in U.S. bond yield and fear of fewer rate cuts by the Fed,” Vinod Nair, Head of Research, Geojit Financial Services, said.

From the 30-share blue-chip pack, Adani Ports, UltraTech Cement, Larsen & Toubro, Sun Pharma, HDFC Bank, ICICI Bank, NTPC and State Bank of India were the major laggards.

Tata Consultancy Services, Reliance Industries, ITC, Asian Paints, HCL Tech and Maruti were among the gainers.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,491.46 crore on Tuesday (January 7, 2025), according to exchange data.

In Asian markets, Seoul and Shanghai settled in the positive territory, while Tokyo and Hong Kong ended lower.

European markets were trading in the green. U.S. markets ended lower on Tuesday (January 7, 2025).

Global oil benchmark Brent crude climbed 0.79% to $77.66 a barrel.

India’s economic growth rate is estimated to slip to a four-year low of 6.4% in 2024-25, mainly on account of poor showing by the manufacturing and services sector, according to government data released on Tuesday (January 7, 2025).

The gross domestic product (GDP) rate of 6.4% will be the lowest since the Covid year (2020-21) when the country witnessed a negative growth of 5.8%. It was 9.7% in 2021-22; 7% in 2022-23; and 8.2% in the last fiscal ended March 2024.

The BSE benchmark climbed 234.12 points or 0.30% to settle at 78,199.11 on Tuesday (January 7, 2025). The Nifty gained 91.85 points or 0.39% to 23,707.90.

Published – January 08, 2025 04:38 pm IST

#Markets #settle #marginally #muted #GDP #growth #projection #HDFC #ICICI #Bank #major #drag