Even as the US central bank seems set to pivot to monetary easing soon, the Reserve Bank of India (RBI) appears in no hurry to do likewise. Its Monetary Policy Committee’s (MPC) decision on Thursday showed no sign of softening its inflation focus.

Not only did it leave the central bank’s repo rate—through which it modulates short-term lending to regular banks—unchanged for the ninth successive time at 6.5%, it hasn’t budged on its long-held “withdrawal of accommodation” stance. The anxiety revealed stems from high food inflation, which puts its headline inflation outlook at risk.

According to official data, the rate of food inflation climbed to 8.4% from a year earlier in June, compared with 7.9% in May, mainly due to a sharp increase in the prices of vegetables and edible oils, and it has now averaged 8% since November.

With nearly half of India’s retail inflation basket made up of food items, this meant that the overall consumer-price reading took a U-turn. Its year-on-year incline was 5.1% in June after averaging 4.8% over the previous two months. So far, so clear.

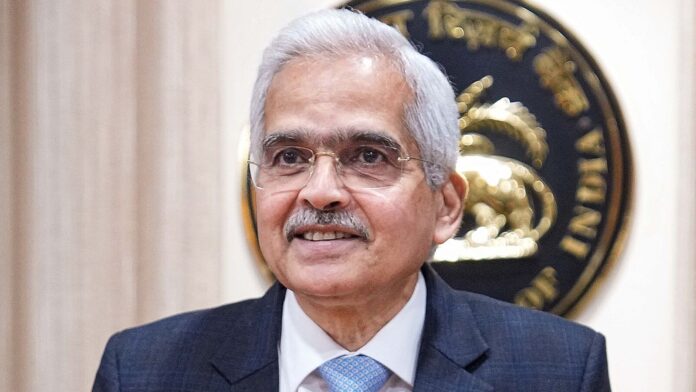

“The MPC may look through high food inflation if it is transitory; but in an environment of persisting high food inflation, as we are experiencing now, the MPC cannot afford to do so,” Governor Shaktikanta Das said. Various factors suggest that food-price pressures might be here to stay.

Were RBI to ignore these and seek price stability without taking food and fuel into account (core inflation is just above 3%), it would risk spillovers and second-round effects, only to achieve a Pyrrhic victory against our rising cost of living, a battle it has waged since 2022.

Therefore, RBI is likely to stay hawkish until retail inflation is durably squashed to its 4% target. How soon that happens may hinge on the rest of the monsoon season’s rains and farm supplies. Thankfully, the economy’s growth is not a worry, which means RBI is under no pressure to take its eyes off inflation.

The central bank sees economic expansion at 7.2% in 2024-25 amid steady urban consumption and improving rural demand, even as investment is strong. The latter two have been concerns, but its broad optimism is backed by a spiffy services-sector performance, high GST collections and other supportive data. That said, global conditions could yet turn adverse.

While RBI’s domestic focus is justified, its course could soon diverge from that of the US Federal Reserve, which is widely expected to ease rates next month. That could shake the external stability of the Indian rupee, should it impact capital flows.

A wider rate gap with the US may draw more debt money into our assets, while equity zest in the West sparked by a Fed rate cut could see stock-market outflows, unless US recession fears dampen it. Though these drivers might balance out evenly, RBI could find the rupee’s ‘managed float’ being tested and its liquidity control stretched.

What seems odd in all this is RBI’s stance. Since it’s not yet neutral, despite its 4.5% inflation forecast for 2024-25, it signals a negligible chance of a quick pivot. Could RBI’s sticky stance imply credence being given to a post-pandemic upward shift in the real rate of interest (adjusted for inflation) that optimizes growth and price stability?

A recent RBI research report lays out such a possibility. In theory, broad neutrality is achieved by a rate that balances investments with savings in an economy. The actual picture is usually more complex. Whatever RBI’s view, a pivot in line with America’s looks unlikely.

#hasnt #RBI #shifted #policy #stance #neutral